Different banks will provide different levels of services. When you initiate a bank connection, the Sway application will let you know which services are specifically available for that provider.

Here is the list of key features that can be provided by banks in the Sway App:

Note that many more features such as CSV export in Xero or Quickbooks format, collaborator management, transaction checks and so on, are available, independently of what the connected bank offers.

💡 To set up a bank account, you must either have the e-banking credentials to connect the account or have the account number to create a manual account.

1. In the menu on the left, select the "Bank accounts" entry.

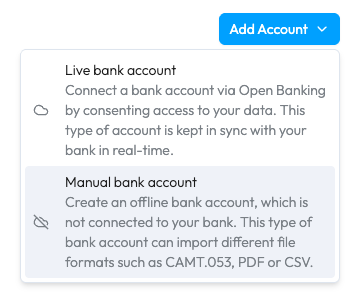

2. Click on the blue "Add account" button and select the "Live bank account" option.

3. Select the country, then the bank. Follow the steps on your bank platform to connect the desired bank account to Sway Finance.

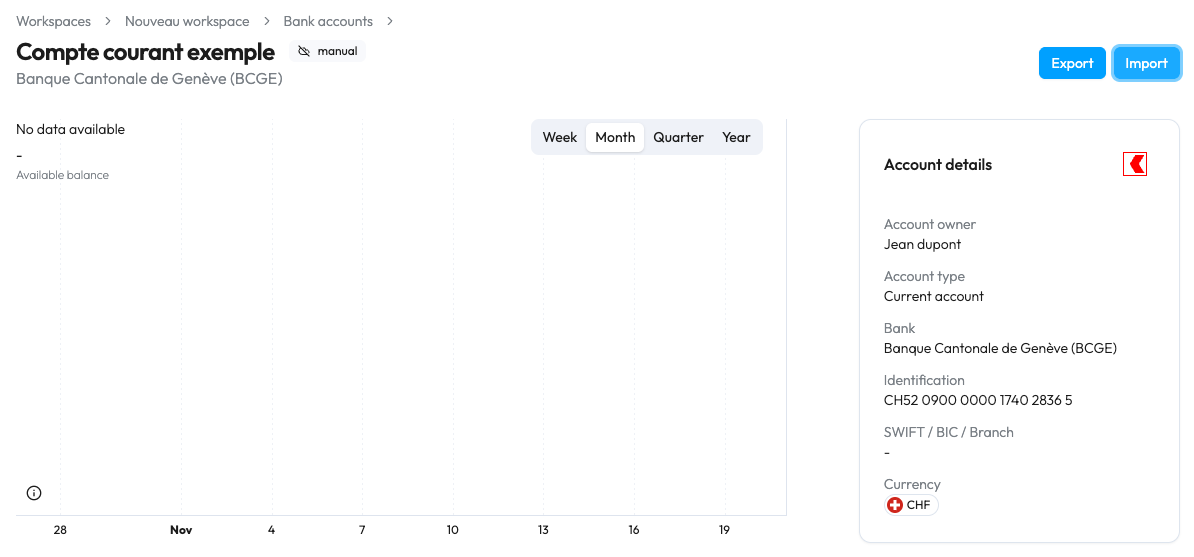

1. Navigate to the bank accounts screen, as described in step (1) above.

2. Click on the blue "Add account" button and select the "Manual bank account" option.

3. Select the country, then the bank. Complete the account information (name, IBAN, etc.) and submit the form: the account is created and ready to receive data.

To learn how to add data to your offline account, please refer to the dedicated FAQ.

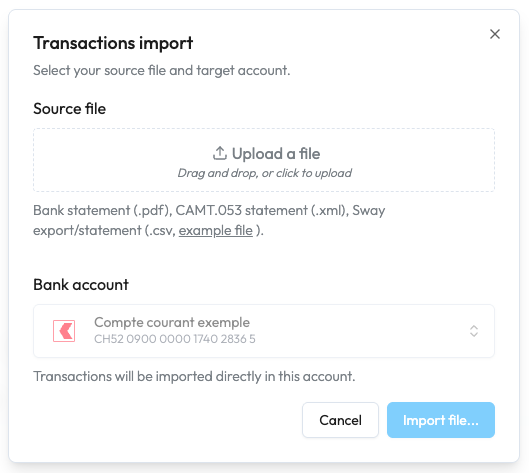

1. From the bank account details view, click on the "Import" button in the top right corner.

2. Select the file or drag and drop it into the designated area. Processing may take up to approximately one minute.

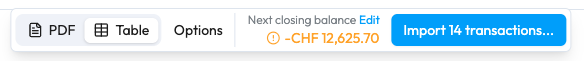

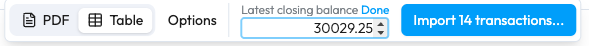

3. If this is the first time you are importing data into this account, enter the initial balance of the account before the first transaction on the bank statement by clicking on the blue "Edit" text in the widget at the bottom of the screen. Click "Done" once you have entered the balance.

4. Then check the following items:

a. If the calculated balance is displayed in green: it matches the closing balance detected in the file, you can complete the import by clicking on the "Import X transactions..." button. ✅ This step is now complete.

b. If the calculated balance is displayed in orange, there is an error either in the initial balance entered or in the file reading. If the initial balance is correct, then check:

i. Does the sum of debits and the sum of credits at the bottom of the page match the sum of debits and credits for the imported transactions?

ii. At least one of the two should diverge, then so (1) check that there's no invalid transaction (e.g. missing date) and that you have the right number of transactions overall.

In the latter case, or if it takes you more than 5 minutes to resolve the issue, simply click the "Cancel" button to cancel the import. Contact Sway support and attach your bank statement to the offline bank account (drag and drop zone in the bottom corner right of the bank account page). The import will be processed within 24 hours.

The aggregated balance is the sum of the amount of money that you currently have on your bank accounts connected with Sway. For instance, if you have one account with CHF 15’000.- and another one with with CHF 5’000.- your aggregated balance will be CHF 20’000.-. Your aggregated balance can be found on the top of your Dashboard.

A revoked consent means that the connection from your bank account to Sway was cancelled. This might happen if you or someone else decided to remove the connection (either within the Sway App, or from the e-banking directly). It’s also possible that the consent you had granted had ran out of validity. In any case you can always reconnect your account by adding it again from the Sway App, and all your data will be available again in no time. If you believe this is a mistake or need any assistance, please reach out to us via our contact form: https://www.swayapp.io/contact

When a consent is revoked (from the Sway app or from your eBanking for instance), connection to the related accounts is removed too. You may however still chose to display this account's data, in the workspace settings. If you do chose to display a disconnected account, the app shows a warning to inform you and potential collaborators, that the aggregated balance and its history, may not be up to date. It consists of a textual warning on the dashboard, as well as an icon near the account logo, in other screens. If you disable the account display, the warning will disappear as well.

Important notice for UBS clients that have opened their account before 2023: If you have a collective signature on the account OR if your contract is linked to a personal UBS account, you will need to request the activation of Open Banking for your account. Please refer to the related FAQ linked below.

In a few easy steps you can connect your UBS accounts to Sway Finance and leverage your banking data for better cash management, thanks to Open Banking.

Here's a 2-minute video that shows you how to proceed.

Please note: This usually applies to UBS clients that have a collective signature OR a linked private account to the same contract.

If you are in this case, UBS has not activated Open Banking by default, and you will need to request its activation. To do so, you may proceed either:

(A) by calling them directly on +41 (0) 848 848 064.

(B) by requesting a call back via this page.

(C) by requesting activation within your e-banking's contact form.

If you choose option C, you may follow the steps described below.

1. Login to your e-Banking.

The following screenshots refer to the web e-banking.

2. Navigate to Mailbox > Messages.

3. Click to create a message to client advisor.

4. Ask them for the necessary documents to activate the services.

You may copy the message below to send to your advisor:

Dear Sir/Madam

Please activate the bLink function for my contract (Corporate API/AV camt reporting/Individual signature, including the necessary form if need be) and check that I may use it to link the following accounts: [LIST OF YOUR ACCOUNTS NUMBERS].

Thank you in advance for your help and have a nice day.

Best regards,

5. Receive confirmation and connect

Once you have received confirmation from your advisor (in some cases this may require to sign additional documents), the services will be activated and you will be able to connect to Sway.

If you need assistance with this process, don't hesitate to contact us.

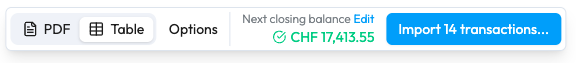

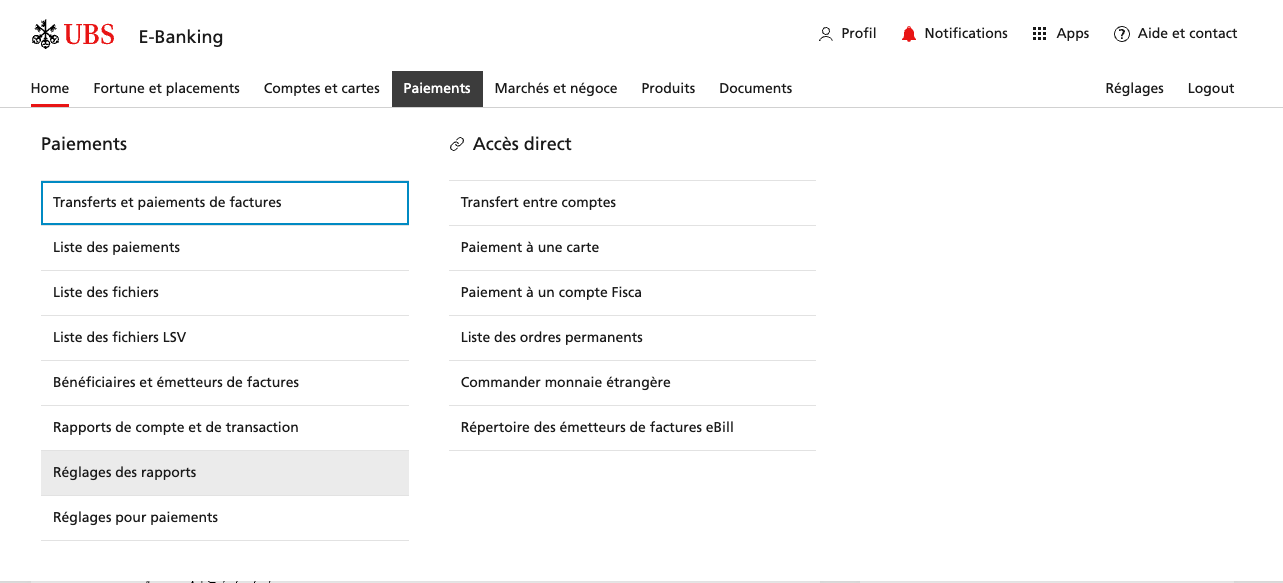

In UBS e-banking, navigate to Payments → Report settings.

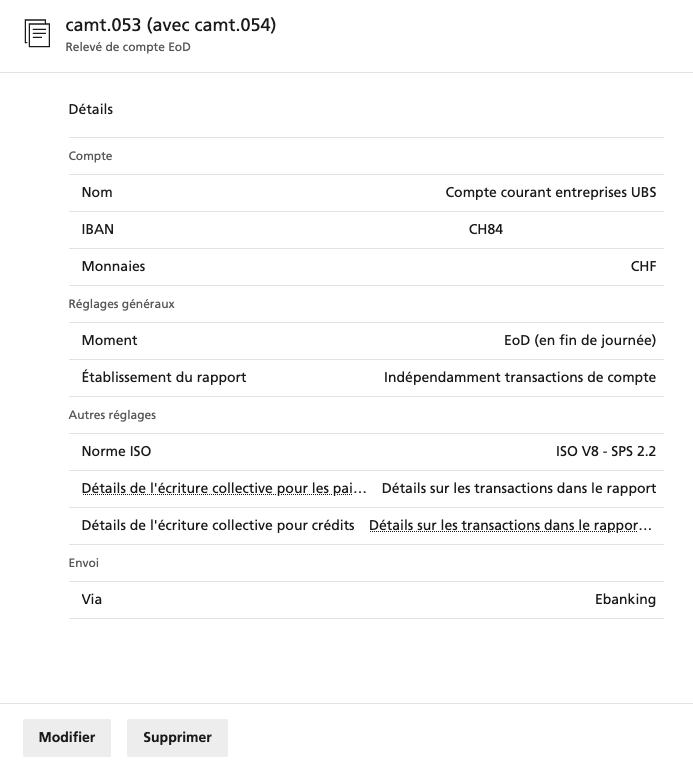

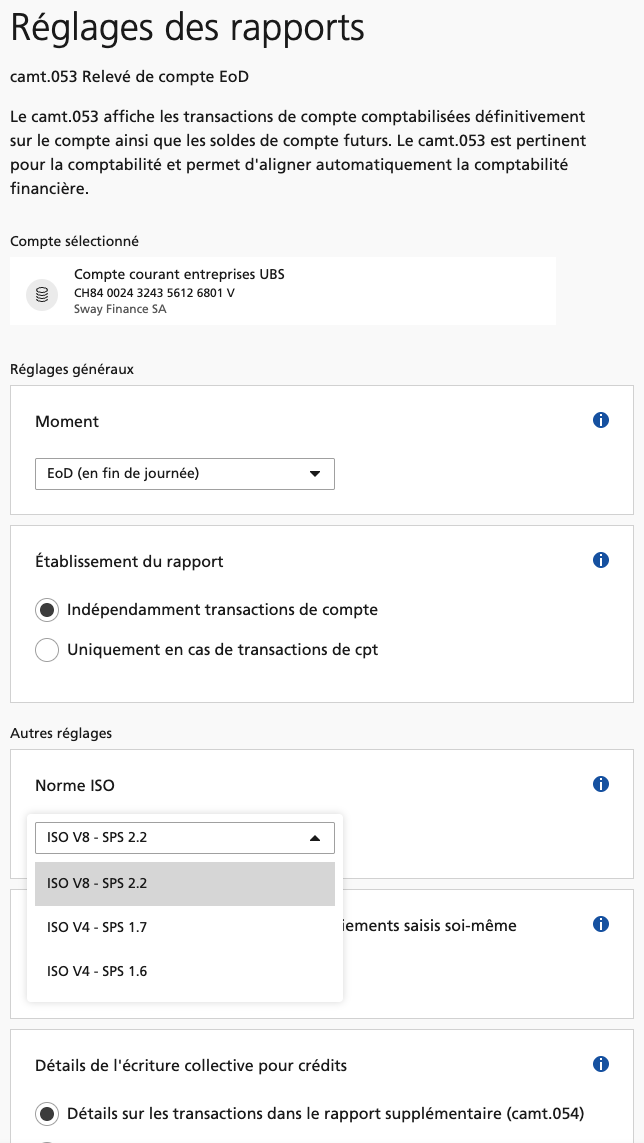

From the options listed on this page, click on camt.053 (with camt.054).

The parameters should be as described below, in particular the "ISO standard" used should be at least ISO V8 - SPS 2.2.

If not, click on 'Edit', enter the settings as described below, and then click on 'Apply changes':

camt053 reports are an iSO standard used to report transactions in an XML file, usually generated by the banks at the end of each day. The acronym camt stands for Cash Management. This standard is widely used across most banking infrastructure to export and/or exchange data. Open Banking data also may be built on top of these reports, hence the importance of using the most up-to-date formats to increase data quality and compatibility.

In a few easy steps you can connect your Credit Suisse accounts to Sway Finance and leverage your banking data for better cash management, thanks to Open Banking.

Here's a 2-minute video that shows you how to proceed.

In a few easy steps you can connect your Valiant accounts to Sway Finance and leverage your banking data for better cash management, thanks to Open Banking.

Here's a 2-minute video that shows you how to proceed.