Sway Finance is a cash management and payment automation platform.

The app connects directly to your bank accounts to show you where you stand in real-time, help you understand your cash movements, make payments in seconds and receive optimisation advice. Our goal is to let you focus on growing your business without wasting time on administrative tasks.

To start using Sway, first download the App from the App Store if you're on iOS, of from the Google Play Store if you're on Android.

You will then be able to sign-up, create a workspace, and connect your bank accounts in minutes. Follow along the video tutorial below to discover how to proceed.

Once you're set-up, enjoy accessing all your accounts in a single app in real-time, while collaborating seamlessly with the people you chose, leveraging the power of Swiss Open Banking.

Here are the steps to follow to set up a new workspace for pre-accounting with Sway Finance.

The whole process takes 10 to 20 minutes, depending on the number and type of bank accounts you add.

If you have any questions, you can contact Sway Finance at any time:

- By telephone or e-mail, see our contact page.

- Via the interactive chat feature in the Sway app by clicking on the "Ask Support" button at the bottom left of the menu bar.

💡 If you do not yet have a user account, start by registering at https://business.swayapp.io/sign-up. You will be prompted to create a workspace at the end of the process.

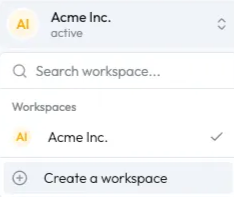

1. From your existing workspace, click on the selector in the top left corner, then select "Create a workspace".

2. Enter the name of your workspace and click on the "Create workspace" button.

✅ The new workspace has been created!

Here's how you can best start using the Sway app:

You can have a quick glimpse at the app's key feature in the video below.

Different banks will provide different levels of services. When you initiate a bank connection, the Sway application will let you know which services are specifically available for that provider.

Here is the list of key features that can be provided by banks in the Sway App:

Note that many more features such as CSV export in Xero or Quickbooks format, collaborator management, transaction checks and so on, are available, independently of what the connected bank offers.

To start using Sway Finance, just download the app from the App or Play store from your phone and sign-up. Don't hesitate to have look at our video tutorial to see how the sign-up process goes.

If you’d like to speak to us, you can reach us via our contact form here: https://www.swayapp.io/contact. We’ll be looking forward to hearing from you.

We take security very seriously. Authentication leveraging biometric sensors on your smartphone is one of the strongest security factors to protect a potential malicious person to access your account.That's why we leverage it by default if it is enabled on your device.

We leverage two factor authentication and biometric authentication to make sure you are the one accessing your account. However, like any security technology, these are limited by how they are used.

Here are some healthy habits to make sure the security in place stays relevant:

An authenticator app is a mobile application that generates unique security codes to help protect your account. These apps create a new 6-digit code every 30 seconds that you'll need to enter along with your password when signing in.

This adds an extra layer of security to your account. Even if someone discovers your password, they won't be able to access your account without the current code from your phone.

Here are the most popular authenticator apps you can use with Sway Finance:

Most password managers also allow this feature, for instance:

To set up an authenticator app with Sway Finance, download one of these apps and scan the code we provide in your security settings. Your app will immediately start generating the security codes you need.

We recommend keeping your authenticator app updated and having a backup plan (cloud-based for instance) in case you lose your phone. If you need help setting this up, contact our support team via our contact form: https://www.swayapp.io/contact.

Your workspace may be automatically suspended in case of non-payment, or in case of non respect of our terms and conditions. This can for instance happen if the payment of your subscription fails too many times. In that specific case, make sure your payment method is still functional and up-to-date. If you think this is a mistake please contact our support via our contact form: https://www.swayapp.io/contact We will get back to you shortly.

This might be because we have detected unusual activity on your account, or some of the terms of use were not respected. If you trust this is a mistake, please get in touch via our contact form: https://www.swayapp.io/contact.

💡 To set up a bank account, you must either have the e-banking credentials to connect the account or have the account number to create a manual account.

1. In the menu on the left, select the "Bank accounts" entry.

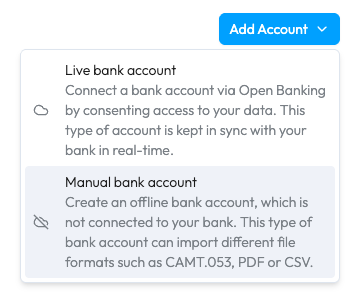

2. Click on the blue "Add account" button and select the "Live bank account" option.

3. Select the country, then the bank. Follow the steps on your bank platform to connect the desired bank account to Sway Finance.

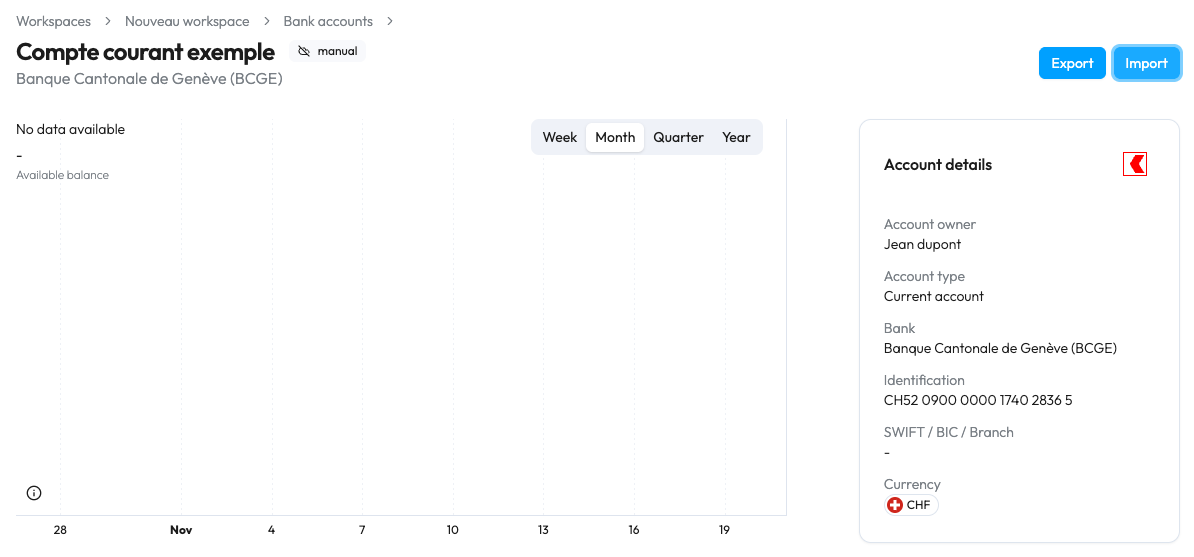

1. Navigate to the bank accounts screen, as described in step (1) above.

2. Click on the blue "Add account" button and select the "Manual bank account" option.

3. Select the country, then the bank. Complete the account information (name, IBAN, etc.) and submit the form: the account is created and ready to receive data.

To learn how to add data to your offline account, please refer to the dedicated FAQ.

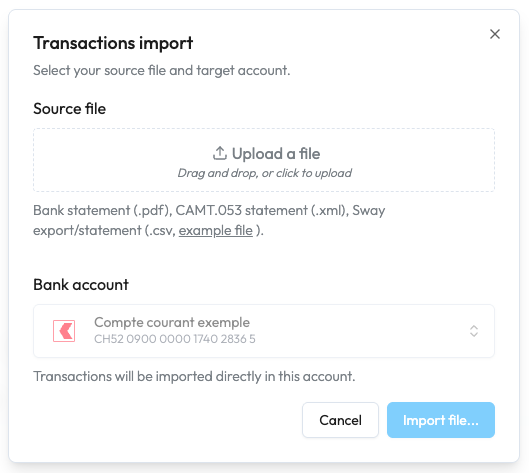

1. From the bank account details view, click on the "Import" button in the top right corner.

2. Select the file or drag and drop it into the designated area. Processing may take up to approximately one minute.

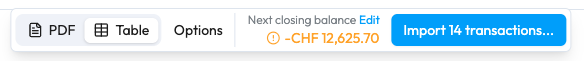

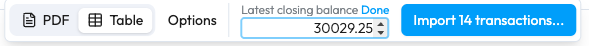

3. If this is the first time you are importing data into this account, enter the initial balance of the account before the first transaction on the bank statement by clicking on the blue "Edit" text in the widget at the bottom of the screen. Click "Done" once you have entered the balance.

4. Then check the following items:

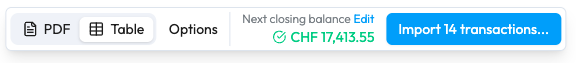

a. If the calculated balance is displayed in green: it matches the closing balance detected in the file, you can complete the import by clicking on the "Import X transactions..." button. ✅ This step is now complete.

b. If the calculated balance is displayed in orange, there is an error either in the initial balance entered or in the file reading. If the initial balance is correct, then check:

i. Does the sum of debits and the sum of credits at the bottom of the page match the sum of debits and credits for the imported transactions?

ii. At least one of the two should diverge, then so (1) check that there's no invalid transaction (e.g. missing date) and that you have the right number of transactions overall.

In the latter case, or if it takes you more than 5 minutes to resolve the issue, simply click the "Cancel" button to cancel the import. Contact Sway support and attach your bank statement to the offline bank account (drag and drop zone in the bottom corner right of the bank account page). The import will be processed within 24 hours.

The aggregated balance is the sum of the amount of money that you currently have on your bank accounts connected with Sway. For instance, if you have one account with CHF 15’000.- and another one with with CHF 5’000.- your aggregated balance will be CHF 20’000.-. Your aggregated balance can be found on the top of your Dashboard.

A revoked consent means that the connection from your bank account to Sway was cancelled. This might happen if you or someone else decided to remove the connection (either within the Sway App, or from the e-banking directly). It’s also possible that the consent you had granted had ran out of validity. In any case you can always reconnect your account by adding it again from the Sway App, and all your data will be available again in no time. If you believe this is a mistake or need any assistance, please reach out to us via our contact form: https://www.swayapp.io/contact

When a consent is revoked (from the Sway app or from your eBanking for instance), connection to the related accounts is removed too. You may however still chose to display this account's data, in the workspace settings. If you do chose to display a disconnected account, the app shows a warning to inform you and potential collaborators, that the aggregated balance and its history, may not be up to date. It consists of a textual warning on the dashboard, as well as an icon near the account logo, in other screens. If you disable the account display, the warning will disappear as well.

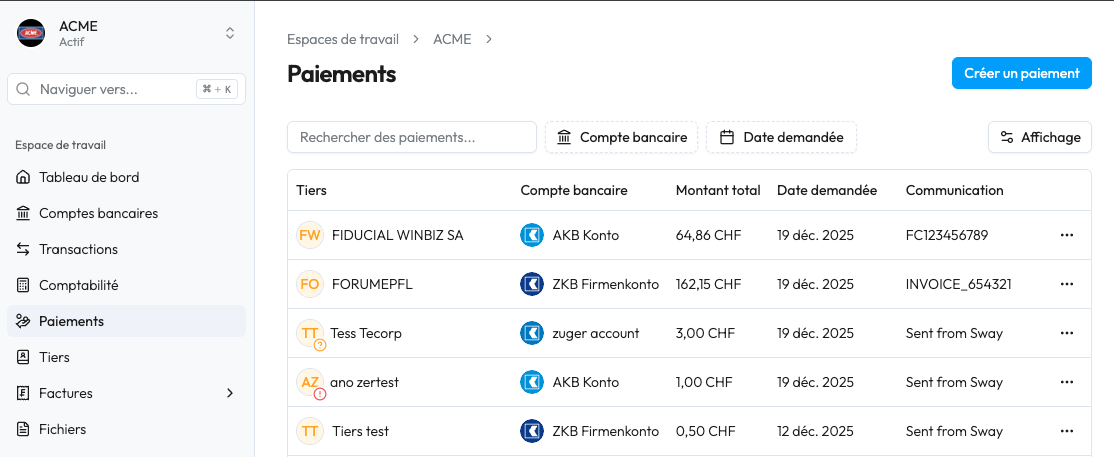

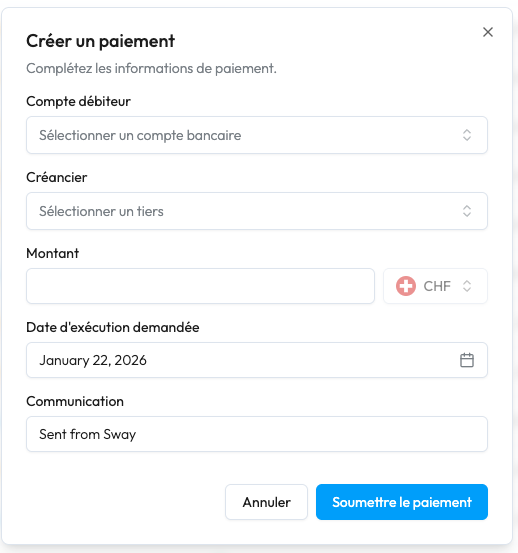

If you have connected your Swiss bank to Sway, you can easily create a payment from the Payments screen.

1. Click on the blue button at the top right labelled "Create payment".

2. Complete the information by selecting the account to be debited, the beneficiary, the amount and the reference.

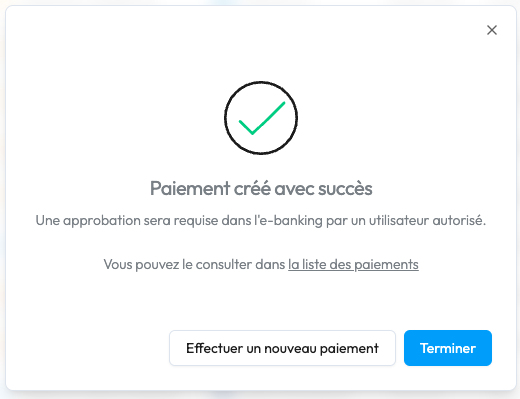

3. Once successfully submitted, the payment will appear in your payment history.

4. ⚠️ A person with signature rights must approve the payment(s) submitted in e-Banking for the order to be executed.

You also have the option to create a new payment from an old payment by clicking on the pop-up menu at the end of the line and selecting "Send again".

Thanks to Open Banking, it is very easy to connect to your bank in order to retrieve your data and make payments via the Sway Finance app.

Currently, Swiss banks are limited to submitting payments. This requires validation via e-banking by a person with signing rights.

European banks allow you to initiate payments by validating them directly via your banking app for immediate or deferred execution.

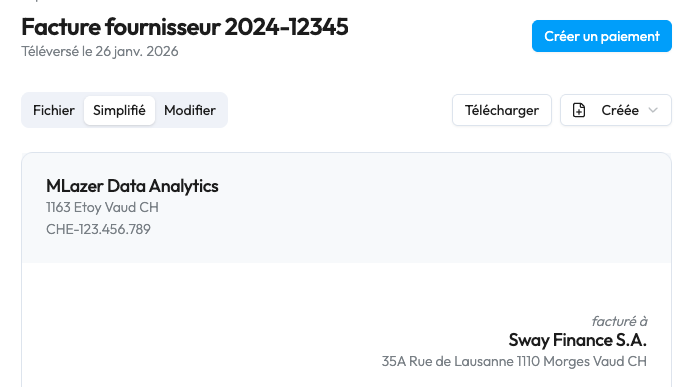

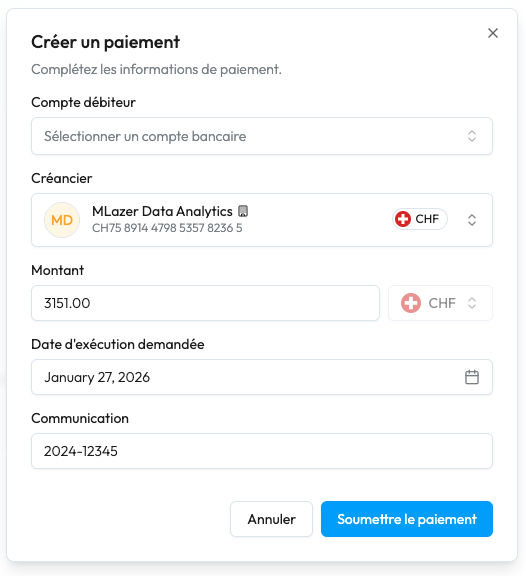

After uploading a supplier invoice to Sway, the data is automatically extracted, thanks to our artificial intelligence algorithms.

If the supplier already exists in the application, they will be automatically linked to the invoice.

Alternatively, you can simply click on the dedicated button: the information is pre-filled and you just need to review and confirm the creation of the supplier.

1. Once the supplier is linked, click on the blue button at the top right "create a payment".

2. The form is pre-filled based on the information extracted from the invoice.

3. Select an account to debit, check the information and click on "Submit payment".

4. Once the payment has been successfully sent, it appears as linked to the invoice.

5. ⚠️ A person with signing rights must approve the payment(s) submitted in e-Banking for the order to be executed.

At the moment payment to accounts that do not have an IBAN are not supported by our Open Banking provider(s). We’re working hard on finding a solution for that and will update the App as soon as that is available. If this feature is important to you, you can gladly let us know by dropping us an email via our contact form: https://www.swayapp.io/contact.

The answer is yes! At the moment you can export your account data as comma separated variable (csv) file with custom columns. This format can easily be imported in modern accounting tools. On top of that, we’ve pre-formatted this export for Xero, Quickbooks, Winbiz, Crésus and Banana, So if you use one of these solution, you can directly import it without any editing needed.

In some cases, we do not receive the necessary information from your bank regarding the counterparty of a transaction. We only have an amount and a date. We therefore display “Unknown Creditor”, respectively “Unknown Debtor”. As soon as your bank will improve their implementation and provide this data, we will be able to provide you with this information.

Unfortunately, banks do not always return complete information about transactions. This may be to specific reasons (for instance in the case of grouped salary payments, ro protect privacy), or not. We are thus limited, and can only display the data we receive. Rest assured that we ware working hard together with the banks to make sure that all information available to you is displayed in the Sway App properly.

Important notice for UBS clients that have opened their account before 2023: If you have a collective signature on the account OR if your contract is linked to a personal UBS account, you will need to request the activation of Open Banking for your account. Please refer to the related FAQ linked below.

In a few easy steps you can connect your UBS accounts to Sway Finance and leverage your banking data for better cash management, thanks to Open Banking.

Here's a 2-minute video that shows you how to proceed.

Please note: This usually applies to UBS clients that have a collective signature OR a linked private account to the same contract.

If you are in this case, UBS has not activated Open Banking by default, and you will need to request its activation. To do so, you may proceed either:

(A) by calling them directly on +41 (0) 848 848 064.

(B) by requesting a call back via this page.

(C) by requesting activation within your e-banking's contact form.

If you choose option C, you may follow the steps described below.

1. Login to your e-Banking.

The following screenshots refer to the web e-banking.

2. Navigate to Mailbox > Messages.

3. Click to create a message to client advisor.

4. Ask them for the necessary documents to activate the services.

You may copy the message below to send to your advisor:

Dear Sir/Madam

Please activate the bLink function for my contract (Corporate API/AV camt reporting/Individual signature, including the necessary form if need be) and check that I may use it to link the following accounts: [LIST OF YOUR ACCOUNTS NUMBERS].

Thank you in advance for your help and have a nice day.

Best regards,

5. Receive confirmation and connect

Once you have received confirmation from your advisor (in some cases this may require to sign additional documents), the services will be activated and you will be able to connect to Sway.

If you need assistance with this process, don't hesitate to contact us.

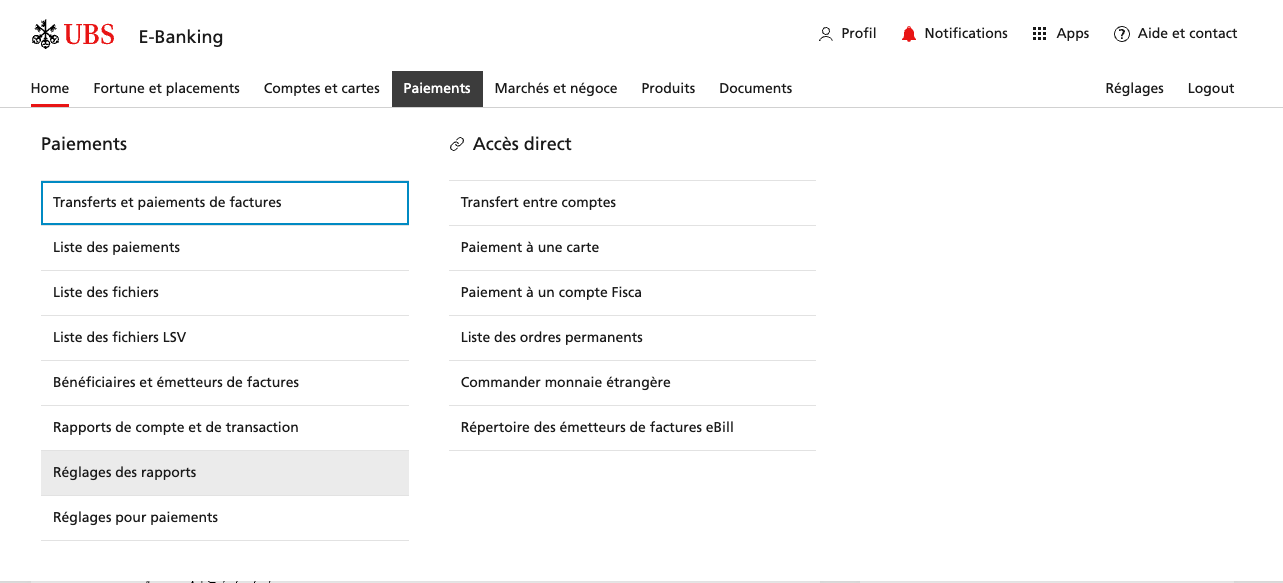

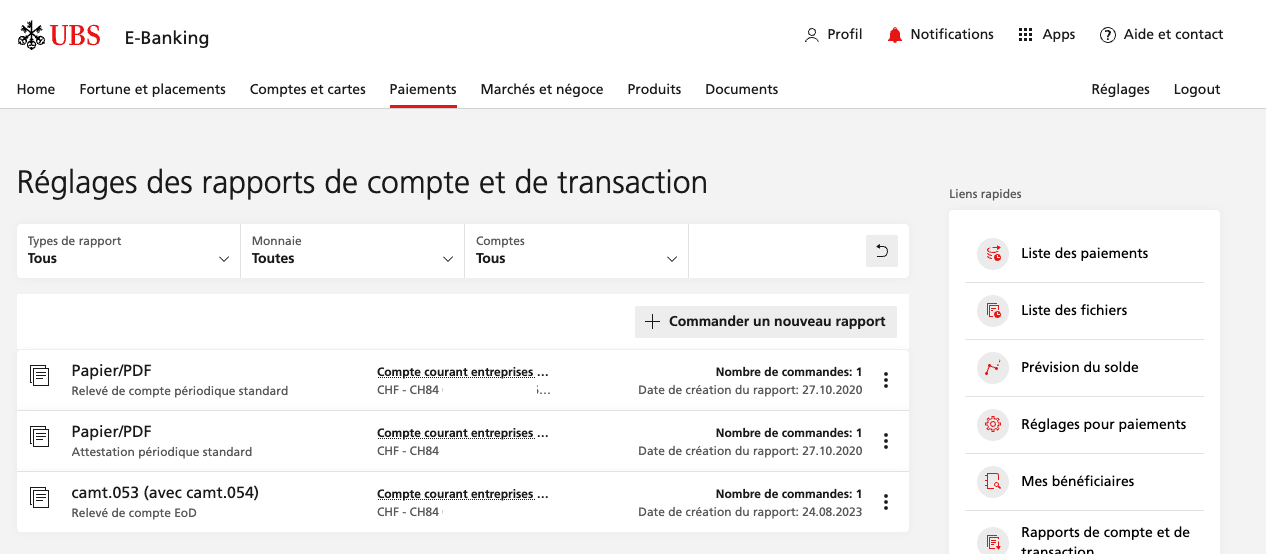

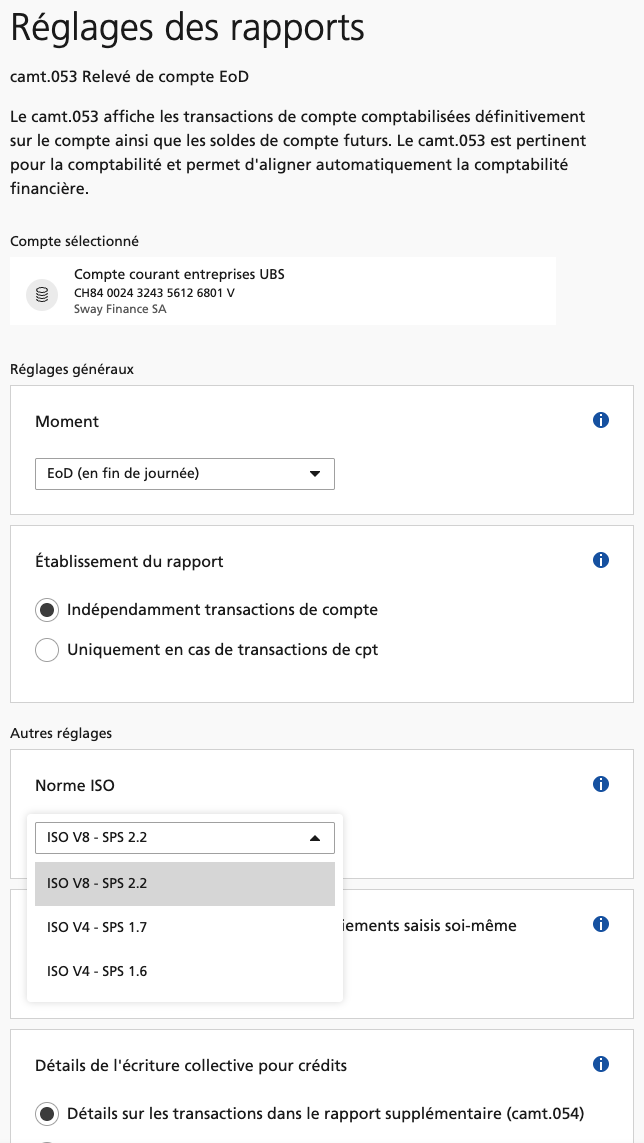

In UBS e-banking, navigate to Payments → Report settings.

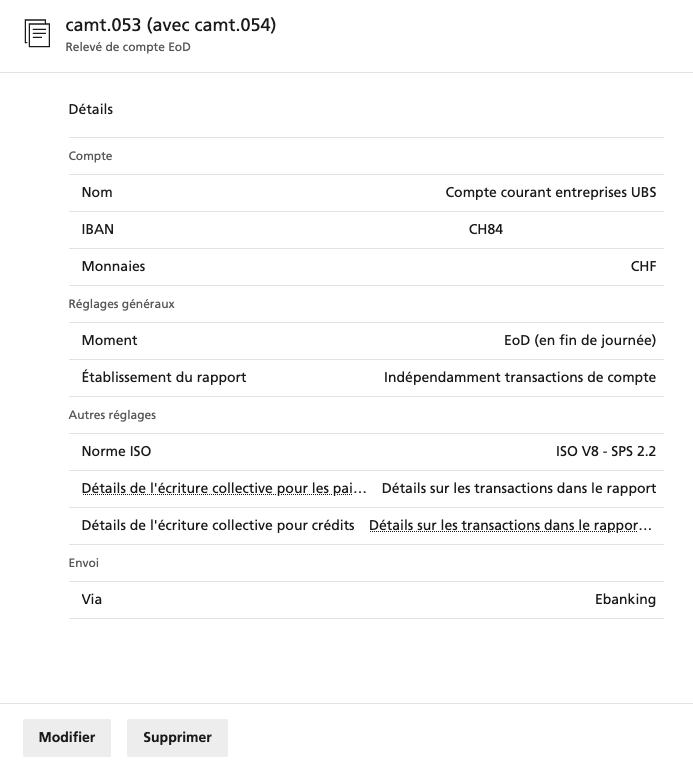

From the options listed on this page, click on camt.053 (with camt.054).

The parameters should be as described below, in particular the "ISO standard" used should be at least ISO V8 - SPS 2.2.

If not, click on 'Edit', enter the settings as described below, and then click on 'Apply changes':

camt053 reports are an iSO standard used to report transactions in an XML file, usually generated by the banks at the end of each day. The acronym camt stands for Cash Management. This standard is widely used across most banking infrastructure to export and/or exchange data. Open Banking data also may be built on top of these reports, hence the importance of using the most up-to-date formats to increase data quality and compatibility.

In a few easy steps you can connect your Credit Suisse accounts to Sway Finance and leverage your banking data for better cash management, thanks to Open Banking.

Here's a 2-minute video that shows you how to proceed.

In a few easy steps you can connect your Valiant accounts to Sway Finance and leverage your banking data for better cash management, thanks to Open Banking.

Here's a 2-minute video that shows you how to proceed.

From the dashboard view, tap on your workspace avatar (here the yellow circle written "AC") to open your workspace settings.

From there, tap to open the collaborator entry. The app displays the list of collaborators within your workspace.

Tap the "plus" button to add a new collaborator. Here, you simply need to provide you coworker's email address and the level of authorisation they should have on your workspace.

Tap the send button. They will receive an email inviting them to join your workspace. If they do not have a Sway account yet, they will be able to create their user and then accept the invitation.

When creating a payment order with a European bank, financial apps like Sway are required by EU regulations to perform a Verification of Payee (VoP). This consists of confirming that the payment beneficiary is known by their bank. It is performed via a third-party API, using the information of the selected beneficiary. If all information is correct and the bank is able to answer successfully, the beneficiary is verified for this and future payments.

The verification may, however, fail for several reasons, usually due to erroneous beneficiary data (e.g., wrong legal name or IBAN) or to an API/Bank check failure. If the verification is unsuccessful, the Sway Finance application will inform you before you confirm the payment. In this case, you may choose to either proceed (if you're certain of the information of the selected beneficiary), or to cancel. If you choose to proceed anyway and the data is erroneous, the money may never reach the intended beneficiary and could be unrecoverable. If you cancel, you can go to the beneficiary details and make sure that the data is accurate or correct it if necessary, then start again.

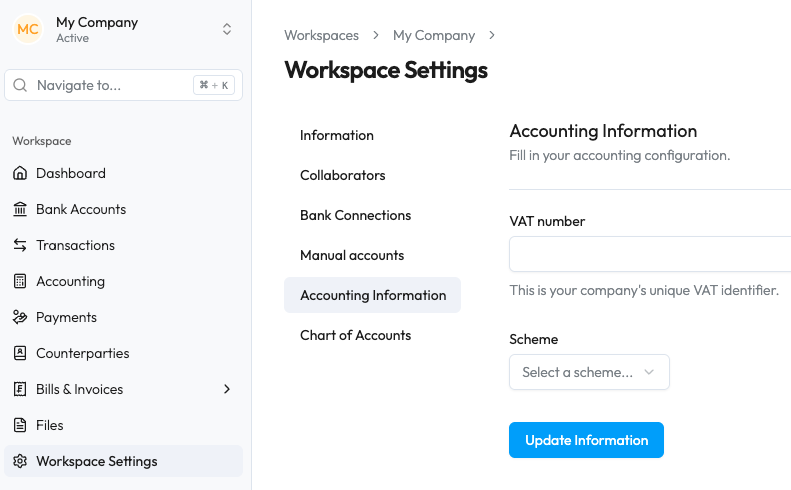

1. In the menu on the left, navigate to the workspace settings ("Settings"), then the submenu "Accounting settings" (accounting information).

2. Select your VAT scheme:

1. Cash basis

2. Accrual basis (currently not supported)

3. Net tax rate

4. Flat tax rate

3. Then navigate to the "Chart of accounts" submenu.

4. There, you'll have the choice to:

a. Use a standard chart of accounts (by clicking on the blue text at the bottom);

b. Upload your own chart of accounts by clicking on the blue "Upload" button.

5. Once you have selected one of the two options, you can check that the chart of accounts is displayed correctly and save it by clicking on the blue "Create chart of accounts" button.

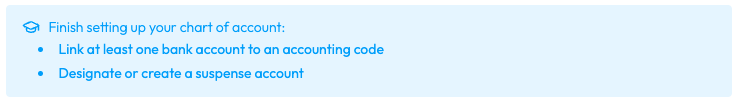

6. Last step: you must assign at least one bank account to one of your accounting accounts and define a suspense account:

i. Click on the first item in the blue list above the chart of accounts: "Link at least one bank account (...)": a pop-up window will appear.

ii. Select a bank account and your corresponding bank account in Sway. Click on the "Link bank account" button.

iii. Click on the second link, "Designate or create a suspense account", and a second pop-up window will appear.

iv. If you already have a suspense account defined in your chart of accounts, you can select it from the list.

v. Otherwise, click on the blue text "Or add a new account instead".

vi. In this last pop-up window, enter an account number (e.g. 1099) and a name (e.g. "Suspense account"). The other fields can be ignored.

vii. Click on Add account.

You can access the "Accounting" menu, where you will find all the transactions for the account(s) you defined above. You will be able to access automatic encoding functions (based on AI and the rules you define), as well as export to your preferred accounting tool.

💡 If you cannot find the "Accounting" menu item, please contact Sway Finance (you can use the integrated chat): this feature is activated upon request by our partners.

Winbiz is a well established accounting software in Switzerland. You can easily optimise your pre-accounting workflows by using Sway Finance:

Here's how to proceed:

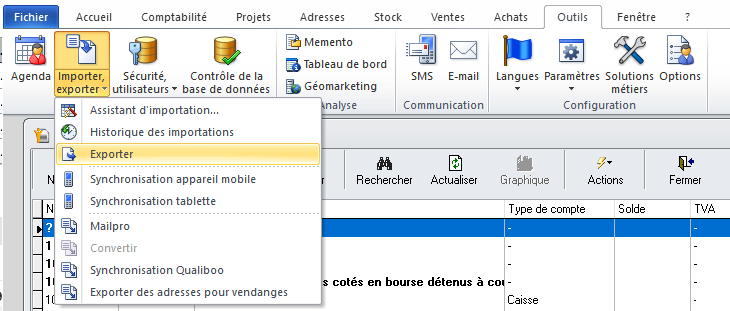

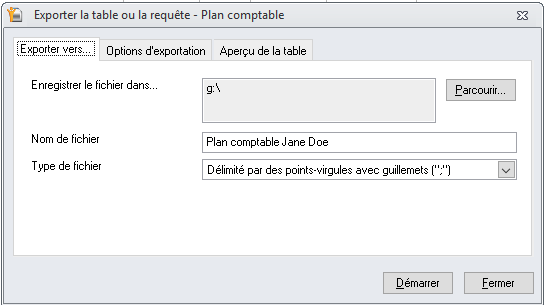

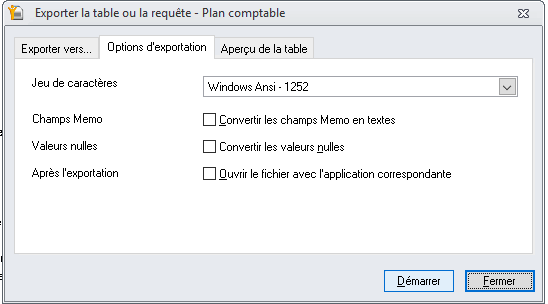

1. Open the chart of accounts (from the Accounting tab).

2. Go to the "Tools" tab, then "Import, Export" > "Export".

3. Check the tabs:

a. Export to...

i. Select the correct destination folder (to find the chart of accounts once exported)

ii. File type: “Semicolon-delimited with quotation marks”

b. Export options:

i. Choose Windows ANSI - 1252 format

ii. Keep all boxes unchecked (Memo Fields, Null Values, After Export).

4. Click on Start.

✅ A CSV file is generated. You can import it directly into Sway Finance in the workspace settings and the "Chart of accounts" submenu.

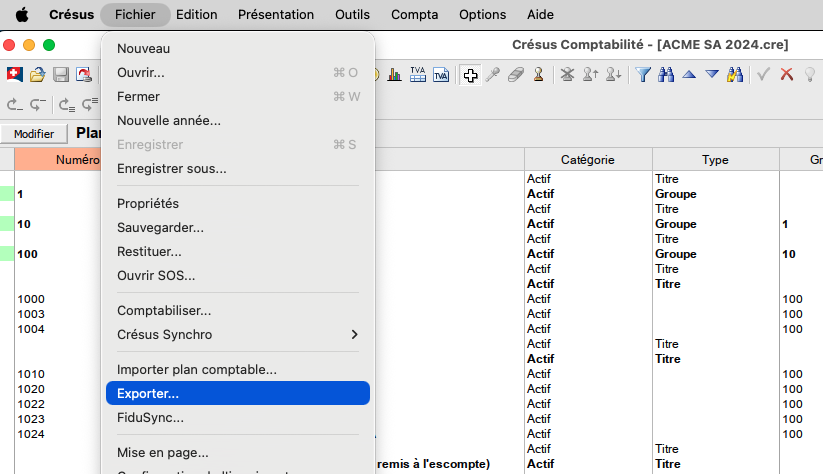

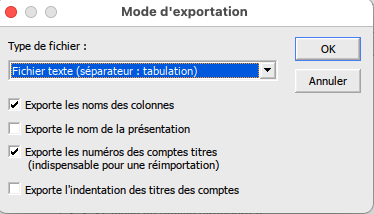

Crésus is a well established accounting solution in Switzerland. You can easily streamline your pre-accounting process by using Sway Finance:

Here's how to proceed:

1. From the chart of accounts view, go to the "File" menu, then "Export...".

2. Tick the box “Export column names”

3. Click the"OK" button

A .txt file is generated. You can import it directly into Sway in the workspace settings, in the "Chart of accounts" submenu.

It's easy to export your WinEUR chart of accounts to import it into a third-party tool such as Sway Finance. For example, you can automate the coding of accounting lines using our AI algorithms and then import them into WinEUR, saving you valuable time.

To export the WinEUR chart of accounts in XML format:

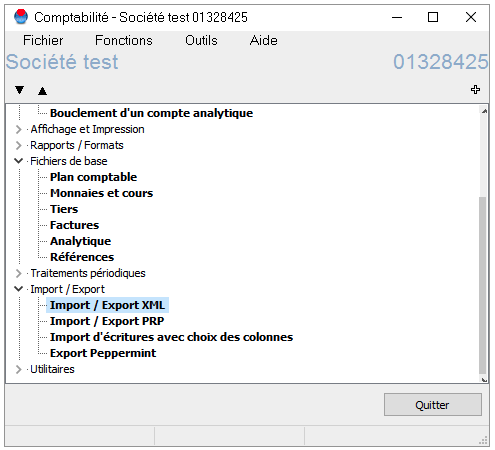

1. In the main menu of the selected company, open the "Import/Export" submenu and select "Import/Export XML".

2. Select the default format and click "Change" (A) or create a new format (B):

3. In the "Export" submenu:

i. Select items to be exported > "Without entries".

ii. Deactivate all options except "Export general ledger accounts".

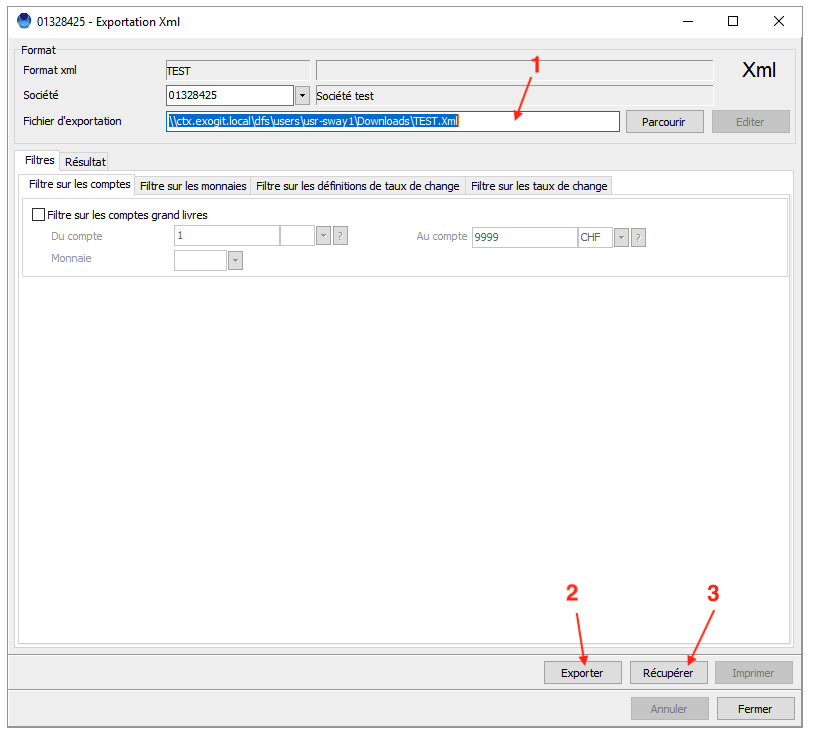

4. Close this window and then click on the ‘Export’ button. The export window will open.

5. Enter the name and/or location of your file (you can restore it later if you use GIT Cloud).

6. Click on "Export" and then on "Retrieve (GIT Cloud)" to retrieve your chart of accounts exported in XML format.

After having automatically encoded your accounting lines with Sway Finance, you can seamlessly export them into the Winbiz format and import them into your accounting.

Simply follow these steps.:

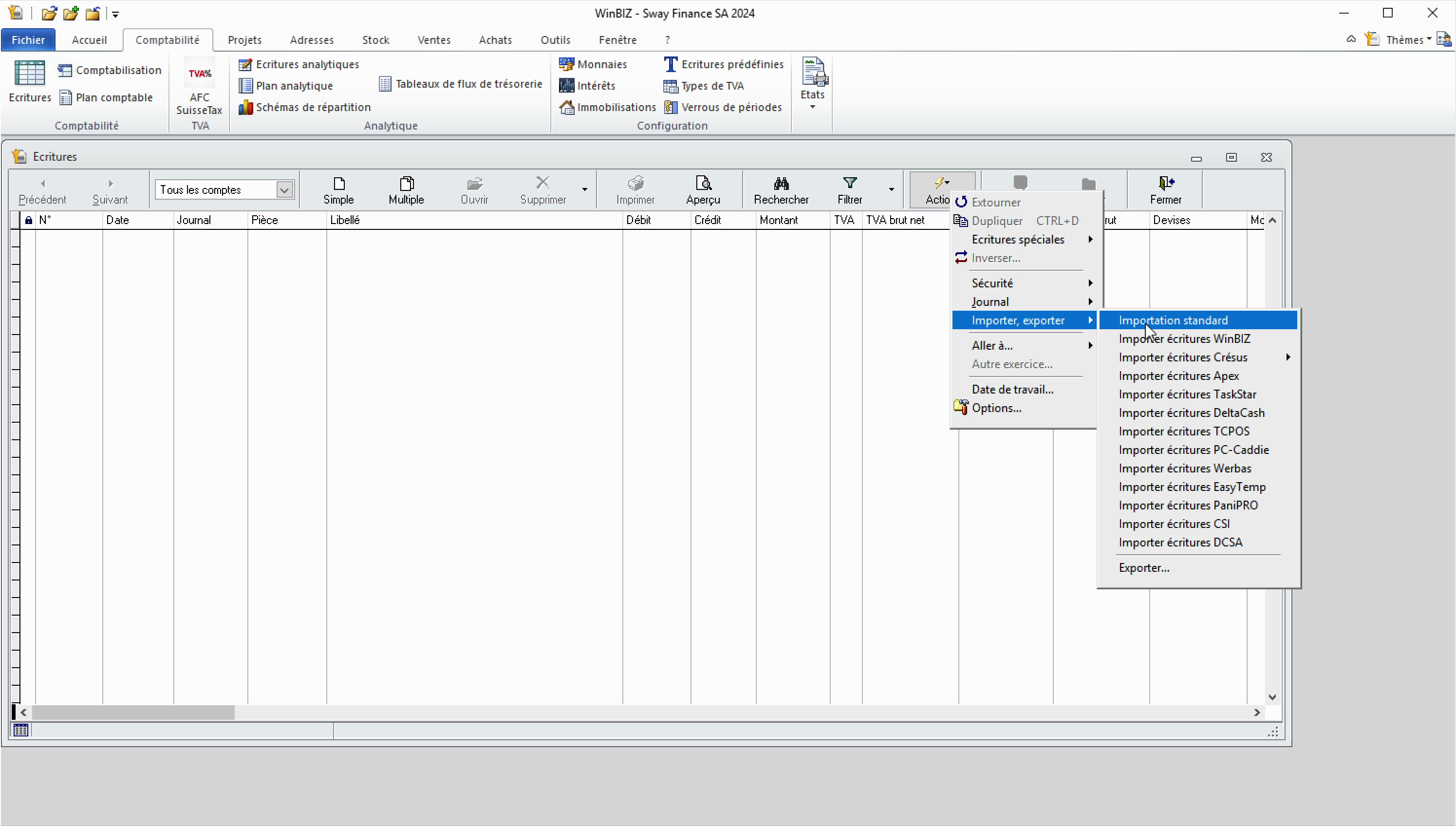

1. From the accounting tab, open the accounting entries.

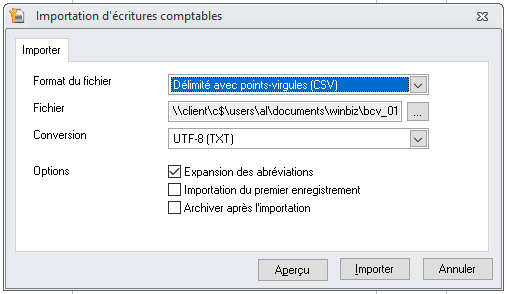

2. Click Action > import, export > standard import.

3. In the import parameters, make sure to select the correct file format. If you exported your data from Sway, select semicolon separators and UTF-8 conversion.

4. Once the import is complete, a success message will confirm the number of imported transactions.

Note:

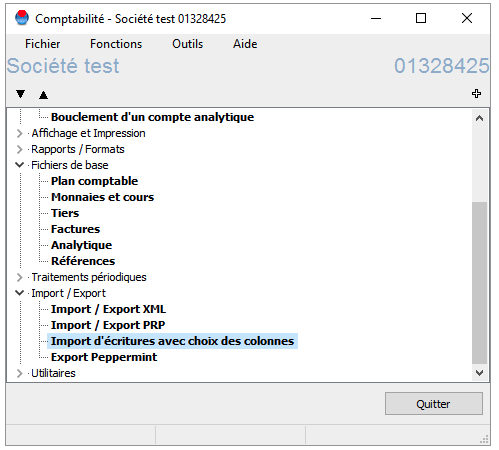

1. From the global menu of the selected company, open the import/export submenu and select "Import entries with column selection".

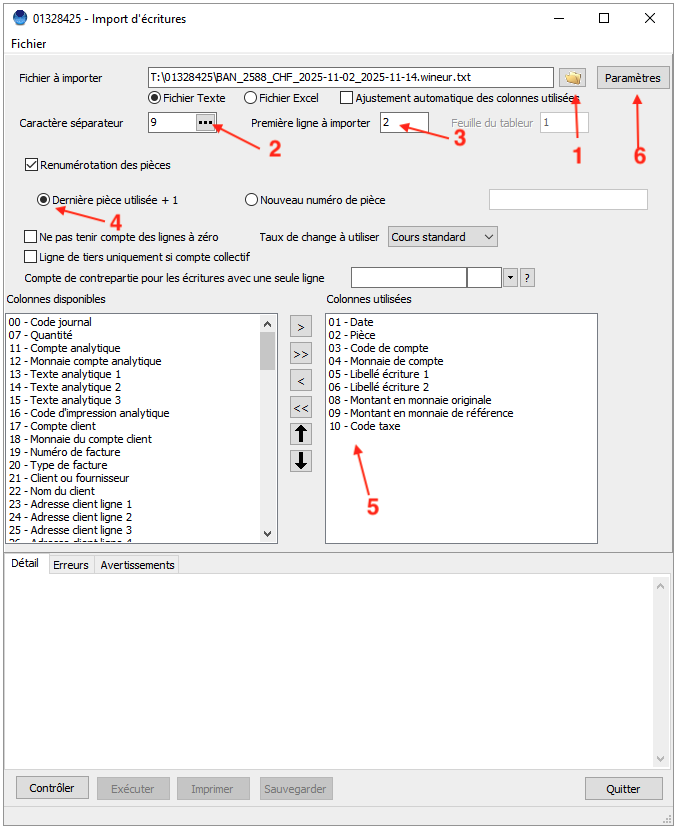

2. Configure or verify the configuration:

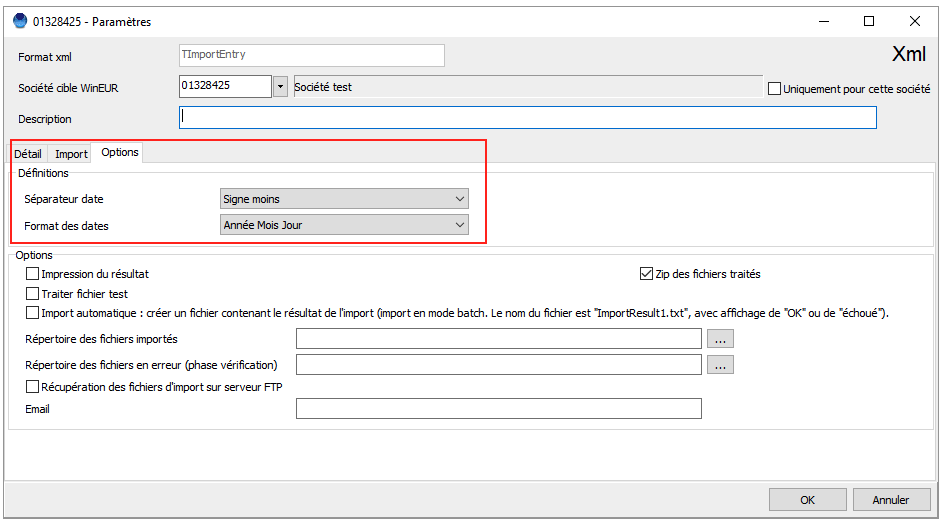

3. Under "Options", check that the selected date separator is "Minus sign" and the date format is "Year Month Day". Click "OK".

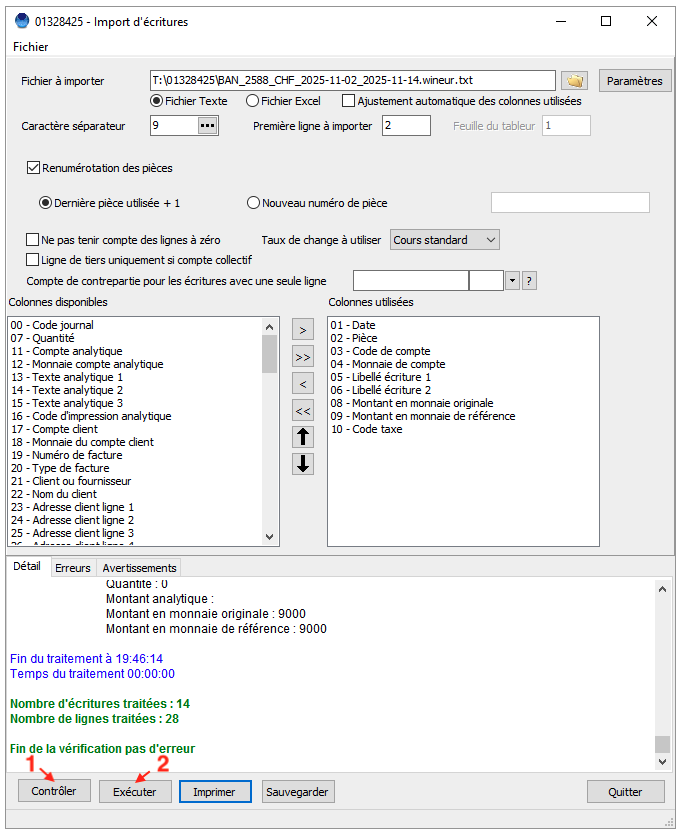

4. Click on "Check" (number 1 in the screenshot below); no errors should be displayed. If errors are displayed, check your configuration in the previous steps. Contact GIT or Sway Finance support if the error persists.

5. Then click on "Run" (number 2 in the screenshot below). The transactions are imported.

6. From the main menu, you can click on "Entry of entries" to view the imported entries.

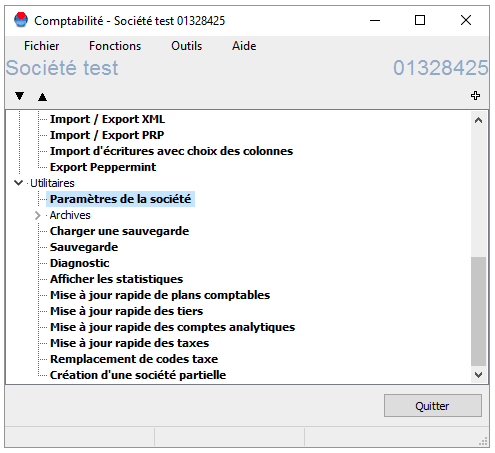

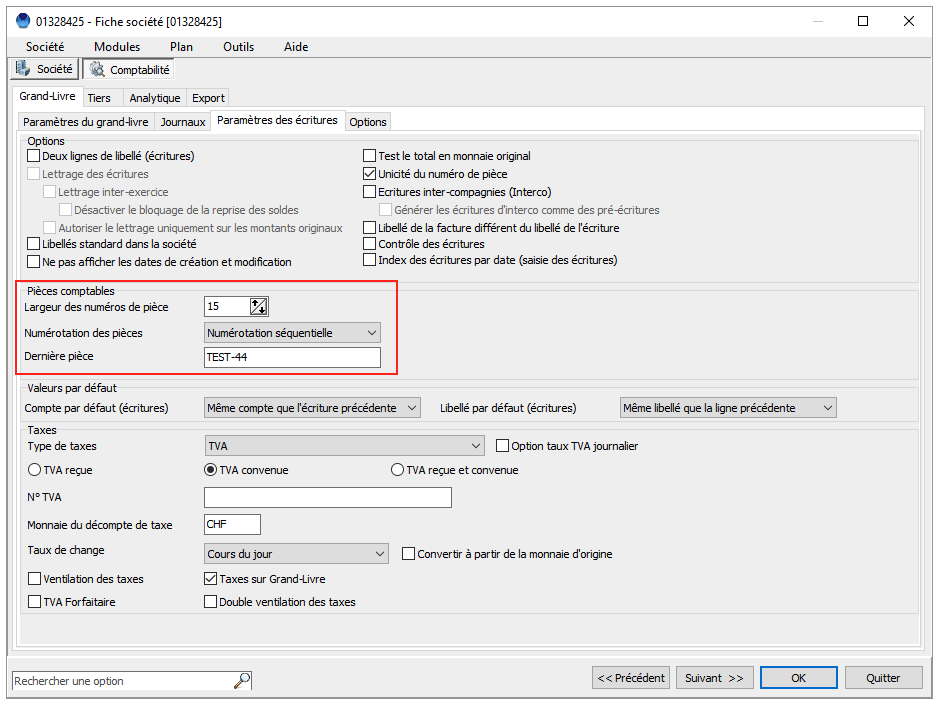

1. From the global menu of the selected company, open the Utilities submenu > "Company settings".

2. In the Accounting > General Ledger > Entry Settings submenu, you can define the numbering of accounting documents. Choose a meaningful keyword and/or simply enter a starting number.

3. Also check that the "Sequential Numbering" option is selected.

4. Click OK. WinEUR will automatically number the documents by incrementing the value from the number you specified.

Once you've signed up, created your workspace, and connected a first bank account, you can easily enable the Xero daily sync. Simply go through the steps below or follow along the video.

1. Invite the Sway Bot

2. Configure Xero Access

Your benefits

Once setup is complete, you'll benefit from:

On top of that, you can easily invite collaborators to your Sway Finance workspace to easily manage bills and invoices, submit payments to your banks and automate your cash management and accounting processes.

Complete setup takes 5-10 minutes and only needs to be done once. Your financial data will then flow seamlessly and securely between platforms.

Inviting the Sway Bot to your workspace will allow enabling workflow automations such as the parsing of PDF bank statements, the pre-processing of your data for accounting, or the synchronisation with third-party tools.

To do so, proceed as follows: